When you start a small business, there are a lot of decisions you have to make, from what services to offer and where your business should be located to what color your logo should be and what font you’ll use. You also have to choose what kind of entity your business will be, and for many first-time business owners, opening shop as a sole proprietor seems like the easiest choice to get started.

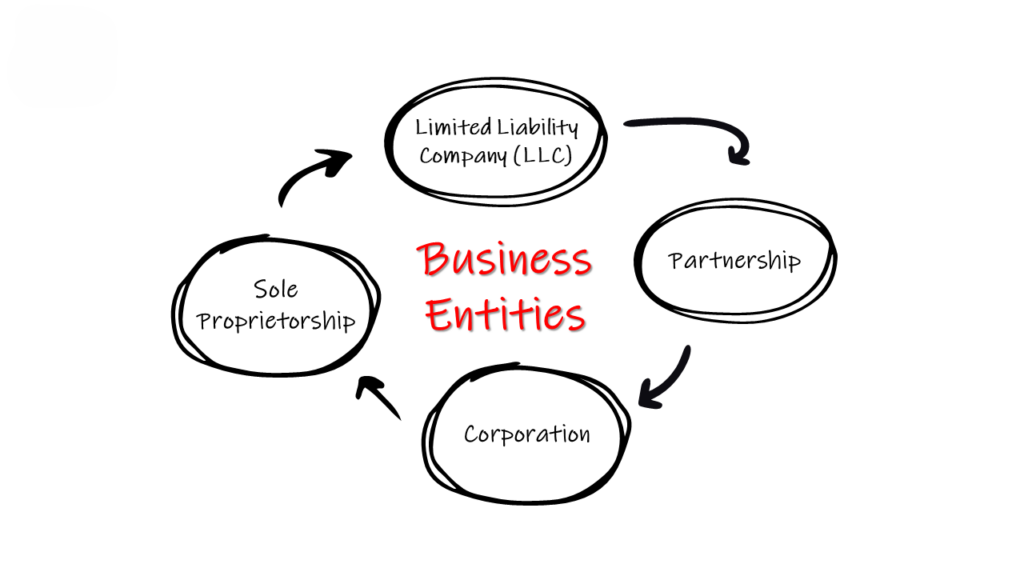

However, the choice of entity type has many implications for your business. Four of the most salient are image, liability, taxes, and flexibility. In this week’s blog, I’m breaking down the pros and cons of the different entity types for your business.

Image

One of the key considerations for a new business owner is how your business is perceived by potential customers and creditors. The business’s image may seem like a trivial concern to someone who just wants to fill a niche they have identified in a market with an improved good or service, but the truth is that the image a business emanates is very important to its success.

While a sole proprietorship or basic partnership are very quick and easy to set up, they can give off an image of neophytes who are not sophisticated businesspeople. On the other hand, an LLC, LLP, or corporation makes clear to potential clients, creditors, and business associates that you have given thought to business and are a more sophisticated businessperson more deserving of their respect.

Liability For Debts or Lawsuits Against Your Business

As a sole proprietor, you literally put everything you own on the line for your business, and I don’t just mean your hard work and dedication. As a sole proprietor, you are personally responsible for any accidents or liabilities that occur at your business. And if you’re sued because of an injury or a broken contract, your personal savings and even your home are at risk. This also applies to the partners in a simple partnership.

However, when you organize your business as an LLC, LLP, or corporation, you can take out loans and conduct business in your business’s name rather than your own. Utilizing these types of business entities and keeping your business’s assets separate from your personal assets limits your liability for any debts or lawsuits your business faces. Creditors, clients, and other sources of potential lawsuits can go after the business’s assets, but not your personal assets, so long as you keep your business’s finances separate from your own.

Tax Implications

The tax implications of each type of entity are something you should discuss with your business/tax attorney and accountant, but we will cover a few facets here. First, sole proprietorships and partnerships are known as pass-through entities which means that all profits from them are treated as personal income for tax purposes. Corporations are subject to different tax laws, and those laws can cost you more in taxes or significantly less, depending on your business’s revenues and profit.

An LLC can be taxed either as a corporation or a pass-through, based on your own choice. However, there are limits to how often you can change this election, so significant planning is necessary to make the right decision for how to make this election. A knowledgeable business attorney can save you many thousands of dollars in taxes over time.

Flexibility

The flexibility to adapt your business to changes in circumstances is one of the big differences between the various entity types. A sole proprietorship or partnership are linked inextricably to the principals of the business and cannot be separated from them. An LLC or corporation, on the other hand, is an entity separate from the owner and can be sold as a whole if you ever want to cash out or retire.

Another facet of flexibility is the ability to raise capital in the future. A sole proprietorship or partnership has limited options other than loans or selling assets. A corporation or LLC, however, can sell interest in the company as a means to raise capital. This will not be a necessity for every business, but you have to ask yourself if it makes sense to limit your options up front. LLCs and corporations also tend to have more flexibility in management structure and shared ownership than the other forms of business entity.

Good Planning Increases the Odds for Success

The most important step you take toward eventual success is often the first. Getting off on the right foot from the start helps make the future easier. That doesn’t mean that it is ever too late to fix any mistakes that may have been made, though. A good business attorney will help you think through all of the possibilities and options and will help you select the correct business form for your business.

If you want to minimize your liability and position your business for major growth, begin by sitting down with us. At Vita Bona Legal Services, we can set up your business entity and establish a sound legal, insurance, financial, and tax strategy to support your business’s future success. Our firm has the real-world business experience that most lawyers lack, so we will have superior insight into your business needs. We can offer a wide range of services to help ensure your business has the best opportunity for success.

To learn more, schedule a 15-minute call at the link below.

https://calendly.com/vitabona/initial-assessment

This article is a service of Vita Bona Legal Services. We offer a complete spectrum of legal services for businesses and can help you make the wisest choices with your business throughout life and in the event of your death. We offer a range of business and estate planning services to help you build and protect your good life. Call us today to schedule.